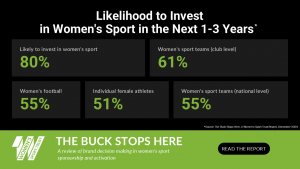

- 4 in 5 brand decision makers say they are likely to invest in women’s sport sponsorship in the next three years

- Domestic club teams, women’s football and female athletes seen as the most attractive properties

London, UK, 11 December 2024 Research from the Women’s Sport Trust shows that the interest of brands in investing into women’s sport continues to grow. Most existing women’s sport sponsors say they will continue their investment, with 85% likely to invest in women’s sport in the coming years while, of all brands surveyed, 80% said they are likely to invest in women’s sport sponsorship. Club level teams are of the greatest interest with 3 in 5 considering sponsorship in this space, 55% are interested in sponsoring women’s football and just over half (51%) said they were likely to invest in individual female athletes.

CEO of the Women’s Sport Trust, Tammy Parlour, says: “There is undoubtably an incredibly positive story to tell around women’s sport properties. The fact that existing sponsors are seeing the value of their women’s sports sponsorships and want to continue their investment is a real win for the industry.

CEO of the Women’s Sport Trust, Tammy Parlour, says: “There is undoubtably an incredibly positive story to tell around women’s sport properties. The fact that existing sponsors are seeing the value of their women’s sports sponsorships and want to continue their investment is a real win for the industry.

“It’s perhaps unsurprising that domestic teams across the major sports are seen as the most attractive potential property to invest in, given the lower entry point for some club sponsorships and the higher volume of deals available. We’d also expect women’s football to continue to be an attractive investment opportunity given its prolific rise over the past few years as well as the opportunities around the upcoming UEFA Women’s Euros in 2025.”

While sponsors of men’s sport identify reach and coverage as drivers of success, in women’s sport an alignment with values and an opportunity to make an impact on a growing rightsholder are important success criteria with 45% of brand decision makers identifying the opportunity to engage with a growing rights holder as a distinct benefit in sponsoring women’s sport.

In the survey of brand decision makers, 69% of the participants were current sponsors of women’s sport. When asked what drove the organisation’s sponsorship of women’s sports they said,

- Showcasing community / social responsibility (77%)

- Changing / reinforcing brand image (68%)

- Increasing brand awareness (56%)

- Promoting corporate image (53%)

- Increasing brand loyalty (50%).

Of the brands that sponsor women’s sport, almost a third of respondents (31%) said that evaluating the potential ROI of the property was the most challenging stage of the deal making process, with 1 in 5 (21%) reporting that communicating the value of the sponsorship to internal stakeholders was the second major challenge.

Encouragingly the survey reports that 86% of respondents said their sponsorship of women’s sport had either met or exceeded their ROI expectations with a third (32%) reporting that their women’s sport activations recorded better than expected delivery on KPIs.

Although the majority of sponsors do have KPIs in place to measure the investment, there is still a risk that the impact of women’s sports sponsorships is potentially under-reported at the moment. The research revealed that while more than half (56%) cited growing brand awareness as a key reason for entering into sponsorship agreements, just 44% track the impact of the sponsorship on brand awareness, and almost 1 in 10 (9%) say they don’t track any performance metrics.

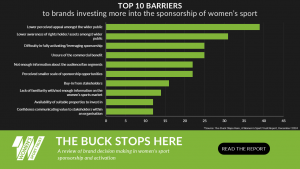

Despite the upwards trajectory of women’s sport some persistent challenges continue to arise. 2 in 5 brand decision makers think that the lower perceived public appeal of the property acts as a deterrent to investment, while 31% identify lower awareness of the rights holder/assets amongst the public as a barrier. While budget and resource restrictions were claimed to be big blockers to activating partnerships, 29% of current women’s sport sponsors also revealed that there was not enough information on the most effective activations for women’s sport, and 21% admitted they were unsure how to engage with fans and potential fans.

Despite the upwards trajectory of women’s sport some persistent challenges continue to arise. 2 in 5 brand decision makers think that the lower perceived public appeal of the property acts as a deterrent to investment, while 31% identify lower awareness of the rights holder/assets amongst the public as a barrier. While budget and resource restrictions were claimed to be big blockers to activating partnerships, 29% of current women’s sport sponsors also revealed that there was not enough information on the most effective activations for women’s sport, and 21% admitted they were unsure how to engage with fans and potential fans.

“The fact that women’s sport sponsorships and activation deliver demonstratable impact on KPIs is a positive. With evidence pointing to the most challenging stage of the engagement process being articulating ROI, the commercial teams need to continue to improve how success is communicated to potential brands,” continued Parlour.

“Alignment with values is clearly key to attracting the right sponsor, but the industry won’t succeed if this is our only focus. The biggest barriers to women’s sport sponsorship remain visibility related. This means that rightsholders need to build an understanding of their audience, support brands to drive successful activations, and work together to proactively raise the visibility of women’s sport.”

Parlour concluded: “We shouldn’t underestimate the effort required to ensure the sustainability of the industry. Stakeholders need to continue the good work and ensure that they hone the craft of selling these properties. We hope that this report will support rightsholders and brands with some key target areas and recommendations to help focus their efforts.”